Deciding whether or not to pay discount points to drive your mortgage rate lower is a problem many borrowers face. This calculator takes in the potential mortgage rate drop from a paying a set amount of discount points, then outputs the savings and time period to recoup the cost of paying those discount points. Once you see the recoup period, you can decide whether you'll be in the mortgage long enough to benefit from paying discount points. A good rule of thumb (and one used in the "built in" calculator scenario below) is to estimate a .25% drop in rate for every 1 discount point paid. So 2 points paid would take a rate from 6.5% down to 6.0% or 5.25% down to 4.75% for example. Be sure to favorite this page to make it easy to return over and over again! Use the link "Back to the Calculators" to return to the Mortgage Calculators menu and try other Calculators Instructions: Starting with the first line of entry fields, change the values in each one to suit your scenario. Hit "Calculate" to move forward. The results will allow you to see the monthly payment with the "Original Rate" and the rate "With Discount Points", the monthly savings and recoup time in months. |

|

Go to Next Calculator:» Refinance Savings Calculator |

Should I pay discount points?

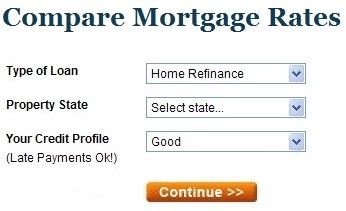

« Back to the Calculators| Not sure if you should pay discount points on your mortgage loan? Fill in the following boxes to find out. |

Sign up for our feed by email or RSS and/or Share below...

Curated selection

- Casino Bonus Utan Svensk Licens

- Casinos Not On Gamstop

- UK Casinos Not On Gamstop

- Nuovi Casino

- Non Gamstop Casinos

- Gambling Sites Not On Gamstop

- Casino Non Aams 2025

- Casinos Not On Gamstop

- Betting Sites Not On Gamstop

- Deutsche Online Casinos

- Non Gamstop Casino UK

- Non Gamstop Casino UK

- Non Gamstop Casino Sites UK

- Non Gamstop Casinos

- Casino Not On Gamstop

- Casino Online Non Aams

- Non Gamstop Casino

- Best Casino Sites

- Non Gamstop Casino Sites UK

- Non Gamstop Casinos

- Slot Sites UK

- Non Gamstop Casinos UK

- Meilleur Casino En Ligne France

- Casino Online Non Aams

- Slots Not On Gamstop

- Crypto Casino

- Casino Online Migliori

- Meilleur Casino En Ligne Français

- Meilleur Site Casino En Ligne Belgique

- Casino App

- I Migliori Casino Non Aams

- Casino Non Aams

- 出金の早いオンカジ

- 파워볼사이트

- Casino En Ligne France Légal

- 카지노 게임 사이트

- Meilleur Casino En Ligne 2026

- Casino Senza Richiesta Documenti

- Casino En Ligne Français