An underwriting fee on a mortgage is charged by the lender who underwrites or approves your loan. Pretty simple right? But because it can be one of the largest fees on your Good Faith Estimate and HUD1 closing statement, it freaks people out.

It’s often times called a junk fee which is insane. There are many people involved in the processing of your mortgage after application…most of which you never see. They are behind the scenes and it’s easy to wonder if they even exist at all. So, if they don’t exist, then the fee is surely bogus right?

And not only do people wonder about the fee, the underwriter usually gets blamed when something goes wrong. I’m not saying underwriters are perfect and some do wake up on the wrong side of the bed sometimes and can be incompetent but I believe those are few and far between.

It’s not easy being the most hated person in a real estate transaction.

Note: Read Our Top Five Mortgage Complaints!

Underwriting Fee Junk?

It is absolutely not junk. There is an actual human being doing an extremely hard job on the other end of that fee. And you probably notice it more on a refinance since you may roll the costs into your new loan.

It does not go directly to the actual human underwriter but to the company that pays their salary. If you use a broker, it goes to the wholesale lender they used. The wholesale lender will be the one underwriting the loan. Be careful if you see an admin or underwriting fee going to the broker and not the wholesale lender. That I would question.

If you use a big mortgage company or bank, they underwrite their own mortgages in house. It goes to them because they employ the underwriters.

Even though there is automated mortgage underwriting rendering the initial decision, it is the human underwriter that has the tedious job of checking every last piece of paper in your file for accuracy. To learn more about automated underwriting click here.

Mortgage Underwriting Fee Cost

The cost can be anywhere between $500 to $1000 depending on what is included.

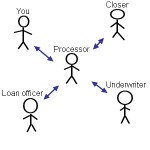

The amount of documents in your mortgage file, by the time it makes it to the underwriter, is massive. And by the way, did your loan officer or processor do their job and submit a complete and accurate file to the underwriter? Like I said, it’s easy to blame the underwriter when the loan officer or processor didn’t do their job. Then when the “you know what” hits the fan, they tell you a horror story about this awful lady who won’t approve your loan.

Here is a video…you don’t have to watch the whole thing since it’s 5 mins long but you know this is how you picture a mortgage underwriter!

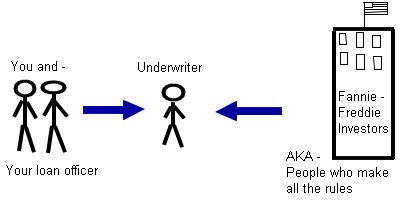

There’s a ton of pressure when underwriting a mortgage. They are in the middle between you and your loan officer and the investor. You and your loan officer want the loan to be approved and the final investor has its rules, guidelines, etc. for the underwriter to uphold. Then, the underwriter has to put his or her name (with their job on the line) on your mortgage telling Fannie, Freddie, etc that they can insure this loan.

It's a tough job, but somebody's got to do it. And they deserve to get paid.

And yes, the lender who collects the fee has some profit above what they pay the human underwriter but they have overhead. They pay for office space to house all the staff, pay salaries, provide health insurance, etc.

Here’s a graphic showing the tough spot the underwriter is in. And if it looks like your kid made this graphic, it’s because I made it myself. A graphic designer I am not but I’m pretty proud of myself for even getting this much done.

I hear people calling not only this fee junk but all kinds of other ones junk too (like the processing fee…for more info on that click the link.

This just tells me they probably have never originated a mortgage or been involved at all in the process of closing a loan other than to be the borrower.

They think pretty much every cost on the GFE or HUD are all junk and can be negotiated away. Which brings me to my next topic…

Can you negotiate it away?

Of course all those other people would say yes! Get in there and show them who is boss. This is a little funny (ok a lot) to me.

Because they have probably never been an insider in the mortgage business, they don't understand what happens when you “negotiate away” something.

The loan officer is just going to increase your rate to cover the cost of that fee.

They might shine you on and pretend they’re doing you a huge favor. But you end up paying for it in the rate.

Underwriting Fee VS. Admin Fee

When a lender calls the underwriting fee an admin fee, that just means they are grouping more than one fee together. If they added the doc prep to the underwriting fee, technically it is not underwriting anymore. To make things easier, they group fees together and call it admin.

Some lenders break out their underwriting fee and other fees like doc prep or wire fee.

Doc prep is printing off the massive amount of papers making up your loan file. The wire fee is the fee for wiring the funds to the title company at closing.

Other lenders may lump all the fees mentioned above into one and call it an administration or admin fee.

Some may charge a $600 underwriting fee and in addition to that a $250 doc prep fee. Or, they may lump them together into an $850 admin fee.

But in the end, without a human being’s stamp of approval, your mortgage wouldn't go anywhere.

Good Luck and I hope this helps!

The Mortgage Insider

Note: Compare Rates of local lender now!

Get a mortgage rates quote from 4 legit lenders Free...Click Here!

Author: The Mortgage Insider