A mortgage processing fee is charged as part of your closing costs and is paid to either the mortgage company or an outsourced processing company.

Usually larger mortgage companies and banks have their own processing department with employees that work for that company or bank. In this case, the processing fee would be paid to the mortgage company or bank.

Some smaller mortgage companies or brokers who do not have their own employees to handle the processing so they farm those duties out to processing companies. The processing fee would then go to the outsourced processing company.

How Much Should the Mortgagee Processing Fee Cost?

It should cost between $300 and $500. You will see it on the Good Faith Estimate and settlement statement or closing statement.

Note: Read Our Top Five Mortgage Complaints!

They are definitely legitimate fees because there is an actual human being doing this job but as long as it is in the $300 to $500 range. Anything above that may be considered a junk fee. Also, make sure you check the Good Faith Estimate cost to the final closing statement cost. This is an easy fee to change and bump up at the last minute so get your closing statement early and compare fees. Although all the new rules (and more coming August of 2015) mean it’s becoming harder to hike up your rate or costs at closing.

What Does a Mortgage Processor Do?

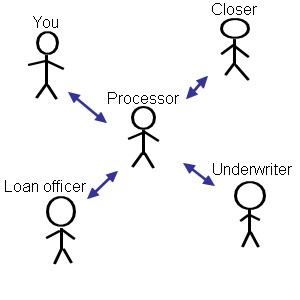

Mortgage processing is in the middle of the journey, shall we say, of your loan. Your loan gets passed on to different people as it moves through the process. The origin is, you guessed it, origination. This is where you and your loan officer or broker are working together to craft a mortgage fitting your situation.

There is a fee associated with that called the origination fee. Click here to read more.

After that is complete, your loan or file gets moved to the processor. This involves gathering all the information from the loan officer and you needed for an approval, checking every number on every document to verify accuracy, submitting all documents to the underwriters specifications, clearing all other conditions needed by underwriting, coordinating closing with underwriting and title, and keeping you and the loan officer abreast of the events.

Think of a mortgage processor like a junior underwriter. Their job is to pre-underwrite the file before submitting it to underwriting for the full underwriting and approval. A good processor can make everyone's lives easier and a bad one can reek havoc. But that is the way in every industry. Hopefully you'll get a good one!

So, back to your file's journey. Processing goes to underwriting. To read more on that click the link. Then, underwriting goes to closing.

The processor is one person who stays in contact with the file from the time they get it from the loan officer to the time it closes and funds.

After you sign the initial application, you will probably be dealing with the processor until closing. The loan officer may get involved again if there is a problem or the terms of your mortgage have changed.

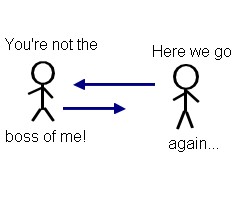

And try to be nice to your processor! I used to be one and it can be a trying and thankless job. As an originator and one of the owners of the company, I was always treated with respect.  If I needed to get a document from one of my clients, no problem. But as a processor (and still one of the owners of the company I might add) I was treated with, on more than one occasion, open disdain and more commonly just as an annoyance.

If I needed to get a document from one of my clients, no problem. But as a processor (and still one of the owners of the company I might add) I was treated with, on more than one occasion, open disdain and more commonly just as an annoyance.

They are asking for documents not to bother you or pry into your personal affairs. They have to get the documentation the underwriting asks for. It is the only way your mortgage gets approved.

Good Luck!

Note: Compare Mortgage Rates of local lenders now!

Get a mortgage rates quote from 4 legit lenders Free...Click Here!Author: The Mortgage Insider