Mortgage Credit Score: How Important Is It?

A credit score obtained by a mortgage company will usually be a little different than scores pulled from a free credit report service or from some other type of business. This is important since your score determines the interest rate and the approval.

You can get an idea of your scores from other sources for other reasons but until a mortgage company pulls your credit, you will not know for certain. And small differences can make a huge difference when it comes to mortgage approvals and rates.

Note: Read Our Top Five Mortgage Complaints!

Why are they different?

A mortgage credit score may be different than one for a car loan or some other credit pull. The 3 credit repositories are TransUnion, Equifax, and Experian. They each calculate a score.

If a mortgage company pulls your credit, more importance will be placed on your mortgage payment history (if you have history) to calculate a credit score. Conversely, if a car company pulls your credit, more importance will be put on your car payment history…etc. If a free credit report service is used, they could be different too.

A car company usually only uses one score. They pull from only one repository like Experian for example. For a mortgage, all 3 repositories must be included. It is called a tri bureau merge. Each repository calculates a credit score and also reports all balances, monthly payments, and payment history. The monthly payments are used to calculate your mortgage debt to income ratio.

Our clients were not happy to say the least when they found out our credit report had lower scores than those they obtained from another source like a free pull.

But they are not always lower. You may find they were higher than you thought or there was no difference. Just be aware there is a possibility they could be different.

There can be incorrect information reported by one or more repositories. If you paid a loan off in full but for some reason it did not get reported to a repository, it will show up on your credit report. When that happens, you have to show the underwriter your loan is paid in full with documentation from the creditor. It is too late at this point to get the repository to change their report so producing the paid in full statement is the easiest way to satisfy the underwriter. You should still send it to the reporting agency and get it removed for the next time.

I saw the recent 60 Minutes report talking about mistakes on people’s credit reports and having seen hundreds of credit reports myself, there is a strong possibility you will have a mistake on yours. In addition to giving documentation to underwriting, you should get that to the credit repositories also and have them remove the incorrect information.

My lender always says FICO score when talking about my mortgage…what is that?

The word FICO score is used all the time in the mortgage industry. There is an actual credit score named the FICO score but in the mortgage world, it just means your middle score. The automated underwriting computer takes into account all 3 of your scores when making a decision for approval.

However for pricing and rates, it is always your middle score which is called in the industry a FICO score.

If your credit scores are 747, 751, and 722, your FICO (middle score) is 747. 747 would be the number your loan officer would use when talking with you and it’s also used to price your mortgage.

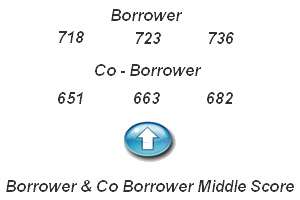

If there are 2 borrowers, the lowest middle score out of the 2 is used. If your credit scores are 718, 723, 736 but your co-borrowers’ scores are 651, 663, 682, unfortunately the spouse's middle score will be used for pricing because it is the lowest of the 2.

Your middle score is 723 but your co borrower’s is 663 and is the lowest of the two, so 663 is the FICO score used for pricing.

There has always been add ons to your mortgage rate depending on the risk. An add on is also known as a hit or adjustment.

But since the mess, there are even more. That is why your credit score is so important. One point difference can mean you pay a higher rate or higher costs. Your middle score or FICO score is used along with your equity position or loan to value to determine the add on.

For example on a refinance mortgage with 20% equity and a 720 FICO score, there would be a .250% add on. You can pay that upfront along with your closing costs or you can increase the rate to pay it. However, if you still had 20% equity but your FICO score was 640, your add on would be 3.00%! If you paid that at closing it would be more than almost all of your other closing costs and if you used the rate to pay it you would have to increase it more than a full point to cover the add on.

What the minimum score I can have and still get a mortgage?

If your mortgage credit score is on the low side, you have 2 hurdles. One is the expense of a low score and the other is getting through underwriting with an approval. 620 is the minimum credit score for Fannie Mae and FHA/VA. However, some lenders may be more stringent with the minimum scores and require higher than 620. And depending on the risk of the mortgage the minimum may be higher.

How do you get a better score?

To get a better credit score, try these tips. First, have at least 3 open accounts with a balance. That could be a mortgage and 2 credit cards or if you do not have a mortgage, a car loan and 2 credit cards.

Credit repositories like accounts for mortgages and car loans because they have a repayment term. They are called installment loans. They like credit cards less because there is no ending.

You need 3 open accounts but try not to go much past that. Your credit score goes down when you have too many open accounts. For your credit cards, try to keep the balance from going past 50% of your credit limit. Your score goes down when your balances are too high. Also, pay more than your minimum payment. And most importantly, do not pay late.

You can go and get a free report and at least it will give you an idea what you are working with.

740 or more is an excellent credit score

700-740 is a good credit score

660-700 is a fair credit score

620-660 is a poor credit score

Good Luck!

Author: Terri Ewing

Previous Post: « True Credit Service - Scam or Not?

Next Post:

More Related Posts:

Did you like this post?

If so, please consider leaving a comment below or subscribing to the RSS feed to have future articles delivered to your feed reader or delivered by email.

I have tried all of them and after a lot of research, I have found that you simply cannot purchase your real FICO scores. Even Suze Orman rants and raves about how important your FICO scores are but in fact, you as a consumer cannot get them! How wierd is that? I clicked the trial offer they have listed on this page and it took awhile to finish the process but eventually I was able to view my score. I just may keep this credit monitoring product. Also gave the page a thumbs up on stumbleupon. Thanks for the info Rob!

corey,

Let me shed some light on why scores consumers get are different than scores lenders get. The credit agencies have a different score calculation for each type of lending. Auto lenders when requesting your credit get back a different score than say a mortgage lender, or credit card bank. So the scores seen by each type of lenders is different from the other.

So when a consumer score is created, those scores are different from what lender see as well since the credit agencies don’t know what type of lending the consumer is anticipating or if the requester is anticipating borrowing any money at all.

Along this vein, often these days employers pull credit as do car, life, health, and auto insurance companies. Since these type of credit score requests don’t specify any type of anticipated lending, these scores will differ as well.

But just because a consumer report shows a “different” score…don’t assume that this score is not “real” as you put it. Consumer credit scores are just as accurate and therefore just as valuable as any other type of score issued to a lender, protential employer, or insurance company.

As you can see, there is no one “real” score.

Hope that helps…and thanks for the Stumble!

In the market for home buying. First thing i did was go get my credit reports from the big 3. score came back of a middle score of 749. so im thinking im sitting pretty good, should not have any surprises. boy was i wrong… the mortgage company pulled my (mortgage) credit report and stated my score is 699? thats a downward swing of 2 credit brakets from excelent to fair? let me tell ya my jaw fell through the floor when i heard this… how would a consumer like myself be able to access such a report since i cant rely on the obvious false information being fed me by the big 3 and i would find it hard to believe that i would be the only one experiencing these seemingly overinflated (regular) reports?

thanks

vince

I had the same problem. I have been re-building my credit after divorce. I pulled my scores from all three bureaus. I had a 651 middle score (Transunion) which would meet the 620 middle score minimum for a mortgage loan. PNC Bank used CBC Innovis to pull my scores and they showed my Transunion score at 609!!! This cost me a mortgage loan! I went home and pulled scores from Myfico.com and they showed the same scores at the three bureaus did. I think these “go between” companies have outdated info. How do we fight this?

Did you have any luck fighting the CBC Innovis thing?? It just cost me a credit account on heating fuel (I live in Alaska…)

(I live in Alaska…)

The big 3 credit bureaus all showed a MUCH higher score than CBC Innovis.

I’m trying to rebuild my credit now and am still teetering around the 640 median score required to get the FHA with down payment and closing assistance loans. I’m getting more and more nervous as I read these stories. First, I’ve been using a company called Lexington Law to help me get the derogatory accounts verified and, if incorrect, removed from my credit reports. I had A LOT of negatives because of years and years with medical issues and no insurance. So, while many of these items have been removed from two of the three reporting agencies, Experian seems to be taking a great deal longer to remove many of the items. Therefore, I still have 16 derogatory accounts according to Experian’s report while, Transunion is showing 6 and Equifax is showing none. All but three of the 16 on the Experian report are medical and all of the ones showing on Transunion are medical. I’ve always heard that medical listing can not be held against you according to the Fair Credit laws. But, others have said that, when it comes to mortgages, ANYTHING can be held against you.

I’ve also got a lot of student loans being reported with all three agencies. I’ve heard mixed information on this subject too. Almost all of the discussions online say that you should not close out a counts that are being reported as accounts in good standing. Te reason for this, according to the posts, say that doing so can lower your credit scores. But, I’ve also read that having too much debt can get you denied for having too much debt and not enough income. I’ve also heard that none of these same rules apply when it comes to getting approved for a ho e loan.

So my questions are as follows:

1. If I have say a median score of 645 and I apply for a home loan, is it possible that I could be denied because of those old medical collections?

2. Is it rue that even if my credit score is high enough to meet the minimal requirements by a lender that the lender may require me (as a condition for the loan approval) to pay off some or all of my debts (collection or otherwise) before approving the home loan?

3. For arguments sake let’s forget any collection or other debts, if I still have a ton of student loans that are in good standing but also not currently being paid on (I’m still currently a student so my loans are in deferment), could that prevent me from getting approved for a home loan because of the amount owed?

I am so worried that I won’t get approved for any number of reasons. I used to feel pretty confident that I could get a home loan once I got the collections under control because I don’t have ANY liens or bankruptcies but, after reading everything I can get my hands/eyes on over the past six months, I’m not sure I even want to put myself through the emotional stress. I’ve never owed a house before and I’m now 40. I’m disabled and raising a six and four year old by myself after my husband’s death last year and I desperately need to get into a house rather than this tiny apartment. My mom moved down here from Houston to help me with the little ones and there is simply just not enough room for all of us now. Any and all information would be greatly appreciated.

Rhonda,

After reading your post, regardless of the credit history, I would not recommend trying to buy a house. A house is a huge responsibility with so many “hidden” costs that nobody really talks about….like you get to buy a new hot water heater when the old one goes…you…not the landlord…you. First time home buyer’s don’t really understand the stress a home can be because they are always told about the benefits. Nobody tells you about the $100 ticket you’ll get if you let your lawn get over grown or park one too many vehicles on the property.

If you need a bigger home, rent a house. There are plenty of spacious single family homes on the market for very reasonable prices from private party landlords. Drive some neighborhoods you want to live in and look for vacant/ugly homes…ask the neighbors who owns the home or do a search online. You may find an out-of-state person owns the property. Email them pictures of what their house has become…telling them you want to rent it, live in it, and over time bring it back to life. Negotiate a discounted rent (shoot for half of what other same sized homes rent for) with this “ugly house” picture tactic and by offering a longer lease…say 5 years…this will appeal to him as they don’t want the head ache. This appeals to you as you get to lock in that discounted amount knowing rent prices are going to rise over the next few years…but you’ll be paying the same discounted rent. If he balks, tell him you’ll hand over 60 predated checks, 1 for every month of the lease term, so he’ll never have to wait by his mailbox for the rent check. He won’t be able to resist that offer.

Last but not least, you’ll need him to prove he is current on his mortgage BEFORE you sign the lease. Ask him for a 6 months cancelled checks or a copy of his last mortgage statement…you don’t want to enter into a lease on a property already headed to foreclosure…just a precaution, but in today’s world a necessary one.

This gets you everything you need…without the short or long term risks and liabilities of actually “owning” a home.

Good Luck…and happy hunting!