There are probably a million complaints about getting a mortgage but these are the top 5 we ran into when we originated mortgages and our readers have voiced to us.

Number One Complaint

Repeated Requests for Documentation

This could be one of two things. One, there is a piece of information on a document you provided that requires additional documentation. A good originator/loan officer will know and try to anticipate every document needed to get you through underwriting so they only have to ask you once.

However, once they get all of your documentation, there may be something in there that needs another document to explain what was on the first one.

If this happens, just ask your loan officer why they need it. If the explanation sounds reasonable, then it probably is.

Note:┬ĀRead Our Top Five Mortgage Complaints!

The second reason for these repeated requests is you may have yourself a bad loan officer. They are more of a salesman than an originator. You may feel like the dog in this video. And if nothing else, youŌĆÖll be talking like him for the rest of the weekŌĆ”which will make you feel better!

Instead of hanging in there with you after the sale and getting the correct documentation, they are off to the next one.

This would be why you would get requests for documentation at the last minute when you thought you were done. Your file has been sitting there needing attention and your loan officer or processor hasnŌĆÖt looked at it in a while. Then, it becomes an emergency and you get the call for more documentation.

And the longer it sits, the more that can go wrong.

ThatŌĆÖs when your loan officer promises you they need nothing moreŌĆ”all is good and youŌĆÖll be through underwriting and closing in no time. But then the frantic phone call.

I also donŌĆÖt know how many times I heard ŌĆ£why do they need this, it is none of their business!ŌĆØ in reference to a lender/underwriter asking a borrower for more documents. And for some reason bank statement are a real source of contention.

I found that people had no problem giving retirement accounts, copies of driverŌĆÖs license, etc. but when you ask for a bank statement they freak out.

But just so you know, if you use any money at all in a bank statement for downpayment, earnest money, reserves the underwriter has to have your bank statement.

And be sure to send in all pages even if one of the pages is a bunch of disclosures with no real info on it. For more on this topic read Automated Underwriting and Reserves.

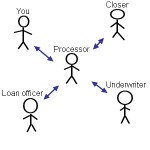

Just remember, the underwriter and processor are going down a checklist of items the computer tells them to get. They are not personally invested in any of the things they are asking of you. Of course, there are some bad apples out there. If the documentation sounds insane then it very well may be. But if it is bank statements, retirement accounts, letters of explanation for jobs or credit issues, that is pretty normal stuff.

Click Here for Complaint Number Two

Note:┬ĀCompare Mortgage Rates of local lenders now!

Get a mortgage rates quote from 4 legit lenders Free...Click Here!Author: The Mortgage Insider